Warren Buffett Just Dumped Half of His Apple Stock. 3 AI Stocks That Are Likely Better Investments

The Motley Fool

AUGUST 20, 2024

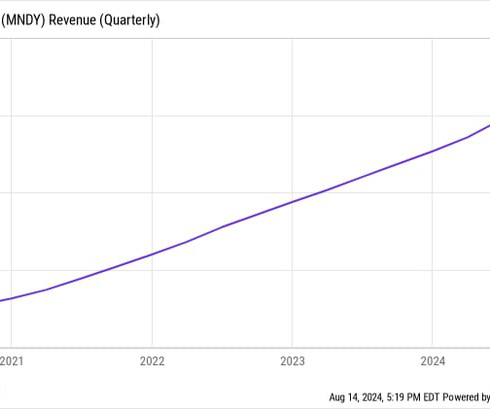

The news that Warren Buffett's Berkshire Hathaway sold 389 million of its Apple shares sent shock waves across the stock market. The stock sale leaves Berkshire with over $271 billion in cash. However, what catalyzed the massive surge in the stock was partnering with Nvidia and placing that company's AI chips in its servers.

Let's personalize your content