What You Can Learn From My Single Biggest Investing Mistake

The Motley Fool

AUGUST 25, 2024

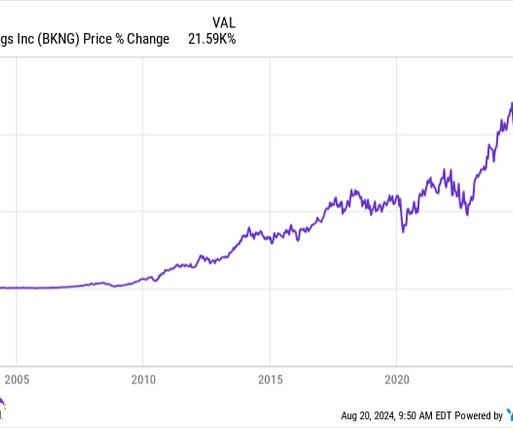

This includes the most widely respected investors, such as Warren Buffett, who has outlined several investing mistakes in his shareholder letters over the years. My Booking Holdings investment I have watched Booking Holdings since its March 1999 initial public offering ( IPO ).

Let's personalize your content