The Fed Just Cut Interest Rates. It May Signal a Big Move in the Stock Market.

The Motley Fool

SEPTEMBER 20, 2024

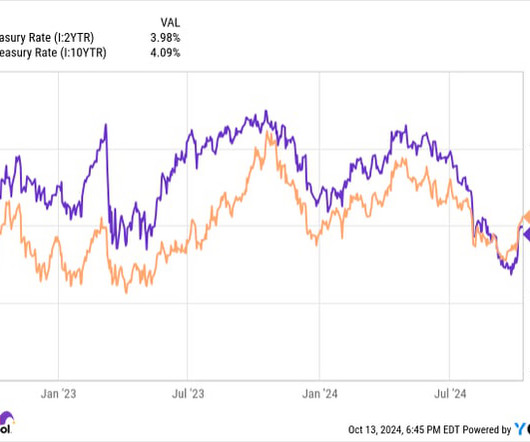

Rate cuts have usually been a positive catalyst for the stock market, though there have been exceptions to that rule. In that sense, rate cuts can be good news for the stock market. The S&P 500 (SNPINDEX: ^GSPC) has advanced 18% year to date, and history says the index could move even higher over the next year.

Let's personalize your content