The Stock Market Has Only Seen This 5 Times in 30 Years. It May Signal a Big Move in 2025.

The Motley Fool

NOVEMBER 17, 2024

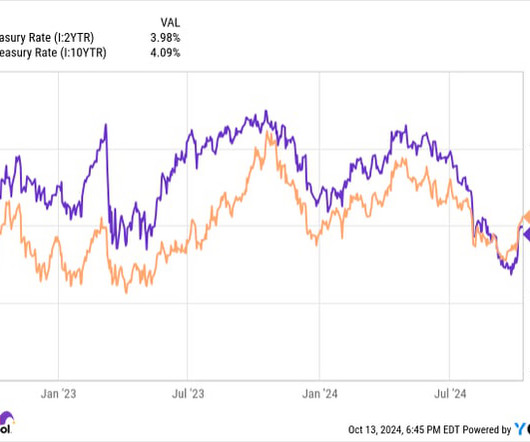

In September, the Federal Reserve started a new rate-cutting cycle, something the stock market has seen only five other times in the last three decades. Policymakers reduce the benchmark rate to stimulate economic growth, which could logically translate into robust stock market returns. stock market indexes.

Let's personalize your content