Want Decades of Passive Income? Buy This Index Fund and Hold It Forever

The Motley Fool

NOVEMBER 15, 2024

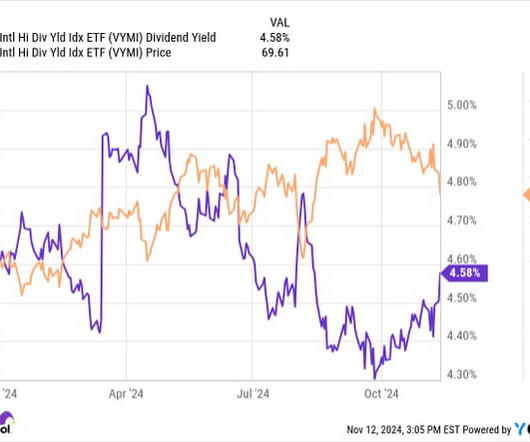

The following exchange-traded fund (ETF) is arguably the best building block around. ETFs are groups of stocks that trade on equity exchanges under one ticker symbol. The fund replicates and follows the Dow Jones U.S. The fund's dividend has increased by 174% during the past decade. Healthcare: 15.8%

Let's personalize your content