This ETF Has Nearly Doubled the S&P 500 Since 2009. Here's How It Could Turn $200 per Month Into $1.3 Million.

The Motley Fool

NOVEMBER 22, 2024

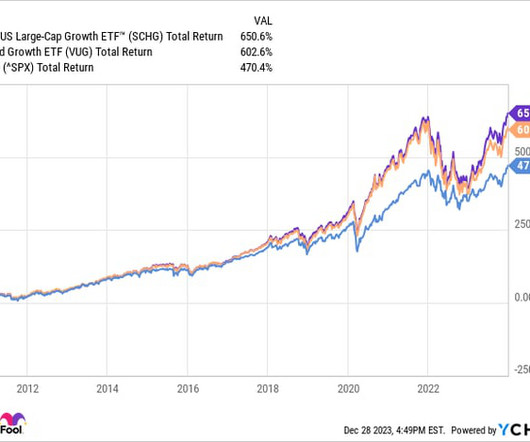

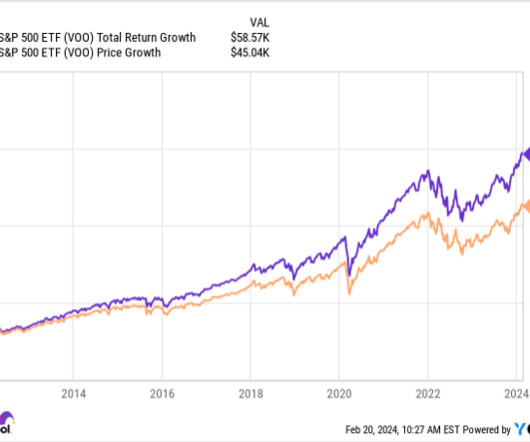

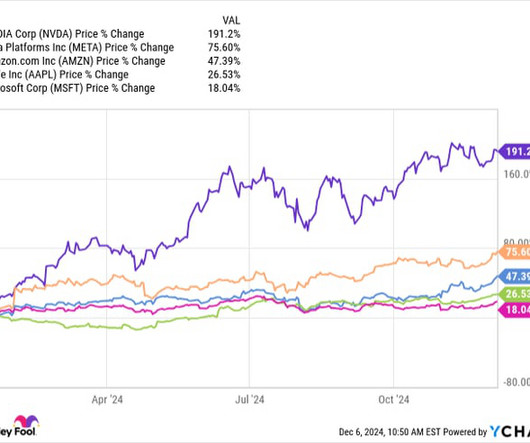

Investing in exchange-traded funds (ETFs) is one of the simplest and most straightforward ways to buy into the stock market. These industry titans may not have quite as much room for explosive growth as up-and-coming companies, but they're also more likely to survive market volatility. million after 30 years.

Let's personalize your content