1 Unstoppable Multibagger Up 2,530% Since 2009 to Buy in 2024 and Hold Forever

The Motley Fool

JANUARY 27, 2024

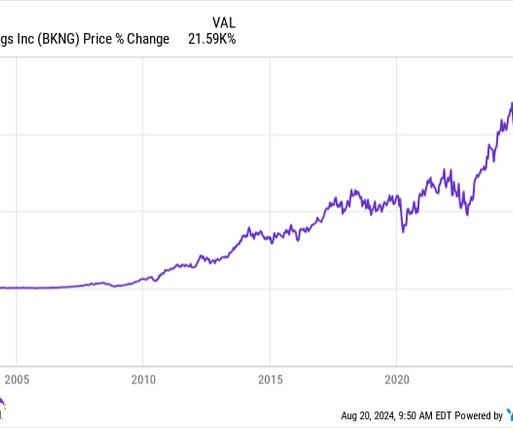

Posting annualized total returns of 26% since its initial public offering in 2009, OTC Markets Group (OTC: OTCM) may be one of the most surprising multibaggers on the publicly traded markets. Corporate services (42%): Three separate markets for public trading: OTCQX Best Market, OTCQB Venture Market, and the Pink Market.

Let's personalize your content