These Were the 5 Biggest Companies in 2009, and Here Are the 5 Biggest Companies Now

The Motley Fool

SEPTEMBER 19, 2024

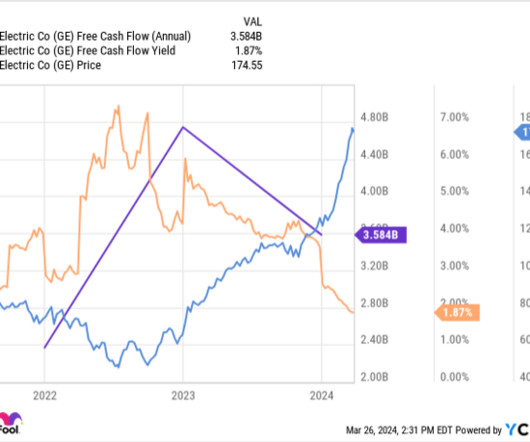

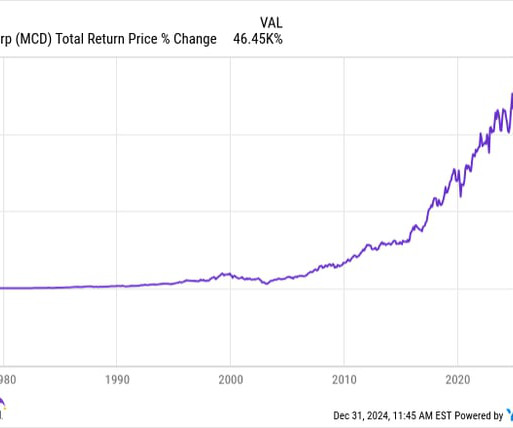

That alone is a huge difference, but there's something even more dramatic behind the numbers: Only one of the companies that appeared in the 2009 list remains within the top five. The five largest companies in 2009 First off, a few notes on methodology. As you can see , in 2009, energy companies dominated the list of largest companies.

Let's personalize your content