This ETF Has Nearly Doubled the S&P 500 Since 2009. Here's How It Could Turn $200 per Month Into $1.3 Million.

The Motley Fool

NOVEMBER 22, 2024

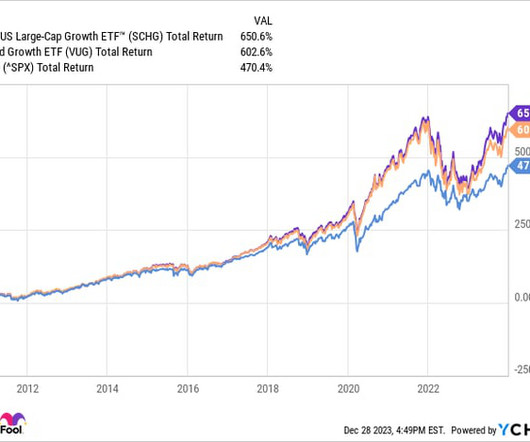

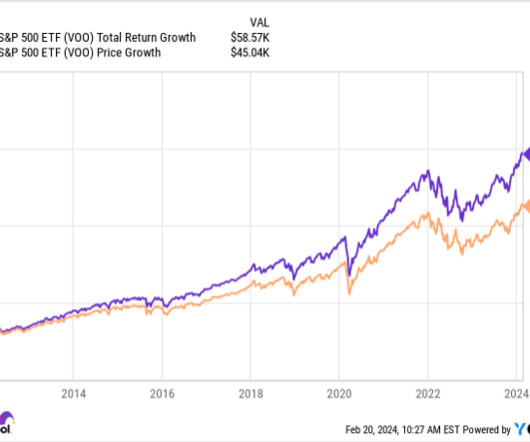

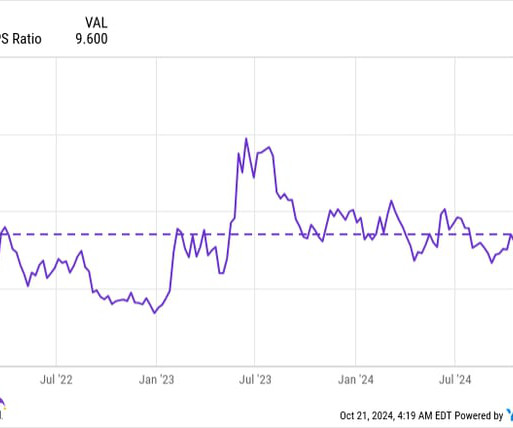

Investing in exchange-traded funds (ETFs) is one of the simplest and most straightforward ways to buy into the stock market. These investments can carry more risk than broad-market funds, but they could also help supercharge your savings. Since its launch in 2009, the Schwab U.S. million after 30 years.

Let's personalize your content