1 Unstoppable Multibagger Up 2,530% Since 2009 to Buy in 2024 and Hold Forever

The Motley Fool

JANUARY 27, 2024

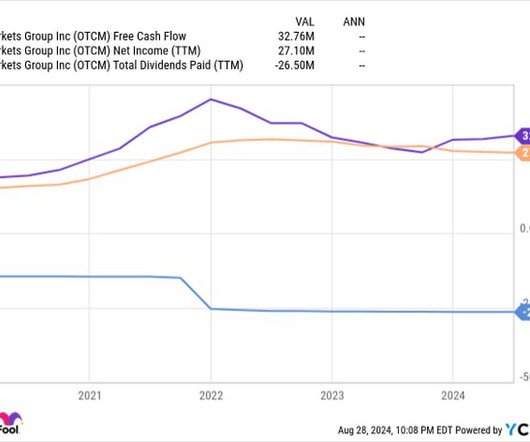

Posting annualized total returns of 26% since its initial public offering in 2009, OTC Markets Group (OTC: OTCM) may be one of the most surprising multibaggers on the publicly traded markets. Let's dive in and see why OTC Markets looks well positioned to continue its multibagging ways in 2024 and beyond.

Let's personalize your content