Inflation Is Doing Something It Hasn't Done Since 2009, and It Could Trigger a Big Move in the Stock Market in 2024

The Motley Fool

DECEMBER 22, 2023

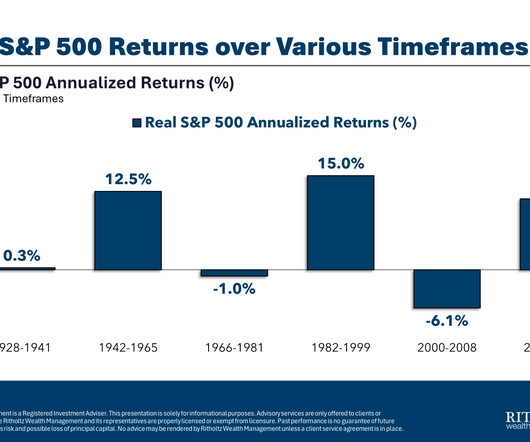

But significant changes in inflation above or below the Fed's target can have a huge impact on asset prices, especially for stocks and housing. The CPI is on track for a steep deceleration in 2023 -- of a magnitude similar to 2009 and the early 1980s. As a result, the S&P 500 ended 2009 with a gain of 26.4% (including dividends).

Let's personalize your content