Why Verizon Stock Inched Higher Today

The Motley Fool

NOVEMBER 13, 2024

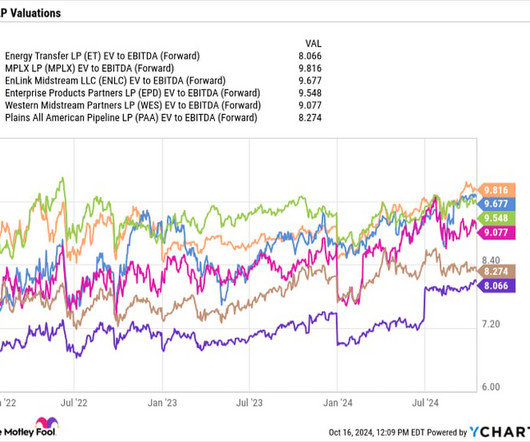

The acquirer added that owning Frontier is expected to increase both its revenue and non-GAAP (adjusted) earnings before interest, taxes, depreciation, and amortization ( EBITDA ) following the close of the deal. And the numbers speak for themselves: Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,529 !*

Let's personalize your content