3 Dividend Growth Stocks to Buy and Never Sell

The Motley Fool

OCTOBER 30, 2024

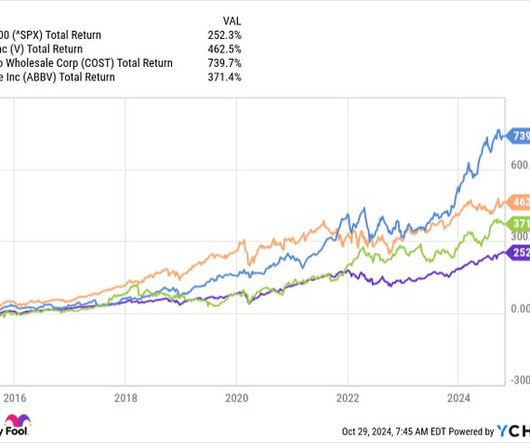

The power of dividend growth investing lies in one simple truth: Companies that consistently raise their dividends have historically outperformed the broader market since 1900. These elite businesses combine robust revenue growth, strong fundamentals, and shareholder-friendly management teams. Image source: Getty Images. Costco's 739.7%

Let's personalize your content