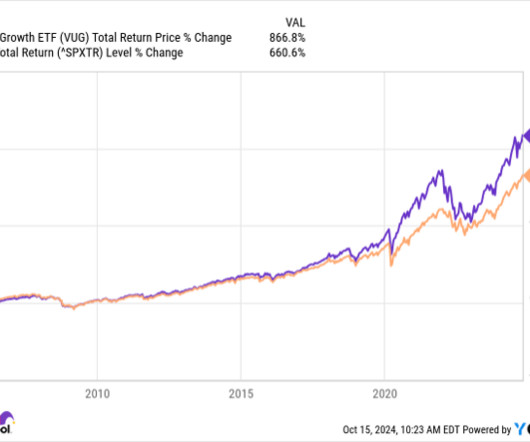

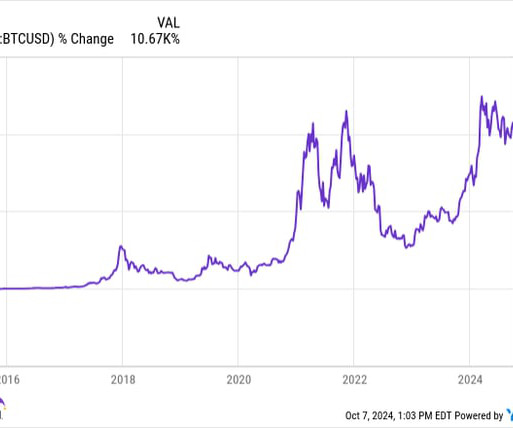

Meet the Only Vanguard ETF That Has Turned $10,000 Into $93,000 Since 2010

The Motley Fool

NOVEMBER 16, 2024

Vanguard markets 86 exchange-traded funds (ETFs). What's more important is how these funds have performed over the longer term. Meet the only Vanguard ETF that has turned $10,000 into more than $93,000 since 2010. companies, many of which are household names. companies, representing roughly 93% of all U.S.

Let's personalize your content