Why Energy Transfer Is My Top Investment for Passive Income

The Motley Fool

OCTOBER 8, 2024

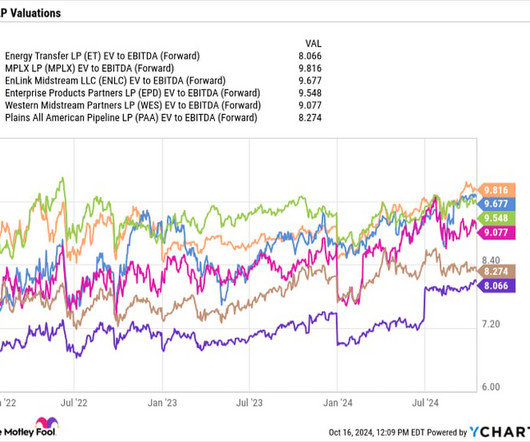

It repaid debt, which steadily drove down its leverage ratio. Today, Energy Transfer has a strong investment-grade balance sheet with a leverage ratio in the lower half of its 4.0-to-4.5x That improving leverage ratio has provided Energy Transfer with increased financial flexibility. times target range.

Let's personalize your content