Why Verizon Stock Inched Higher Today

The Motley Fool

NOVEMBER 13, 2024

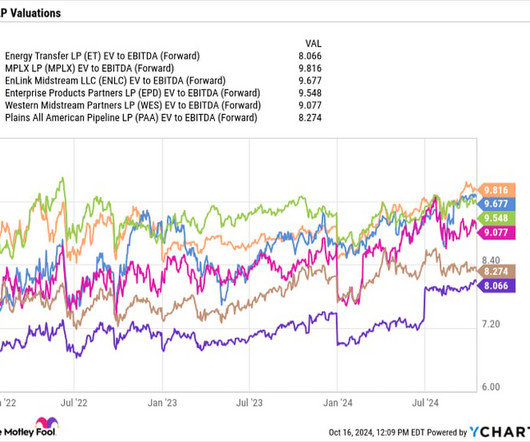

The acquirer added that owning Frontier is expected to increase both its revenue and non-GAAP (adjusted) earnings before interest, taxes, depreciation, and amortization ( EBITDA ) following the close of the deal. It did not provide any financial estimates.

Let's personalize your content