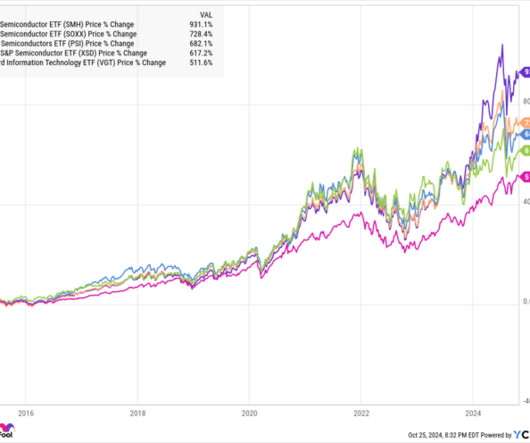

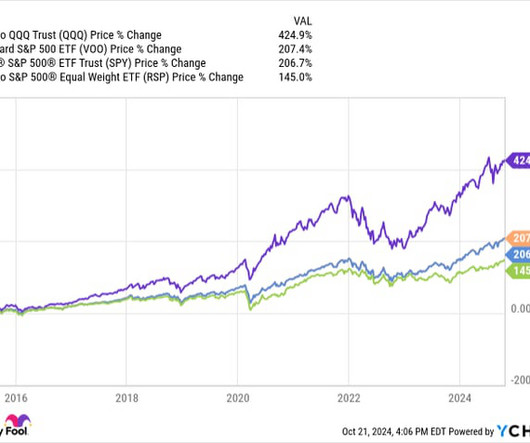

This Is the Best-Performing ETF of the Last 10 Years. Is It Still a Buy?

The Motley Fool

OCTOBER 31, 2024

Exchange-traded funds (ETFs) are a great option for investors. ETFs can be traded easily like stocks, and typically only cost the owners a fraction of a percent for the management fee, known as the expense ratio. Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,529 !*

Let's personalize your content