A Financial Mystery: Investors Paying Tens of Billions of Dollars to Underperforming Mutual Funds -- When Index Funds are Cheaper and Perform Better

The Motley Fool

JUNE 30, 2024

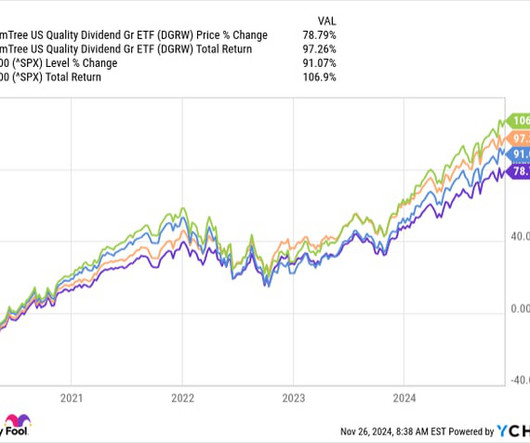

In 2021, investors paid almost $90 billion in total fees on about $14 trillion of actively managed mutual funds to an industry flogging a product demonstrably inferior to index funds. Active vs. passive funds It's quite a problem, and a seemingly puzzling one, too.

Let's personalize your content