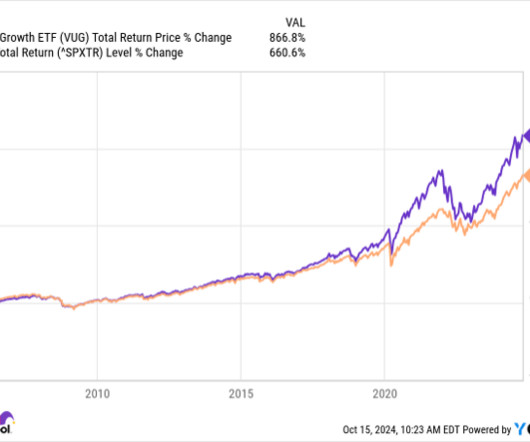

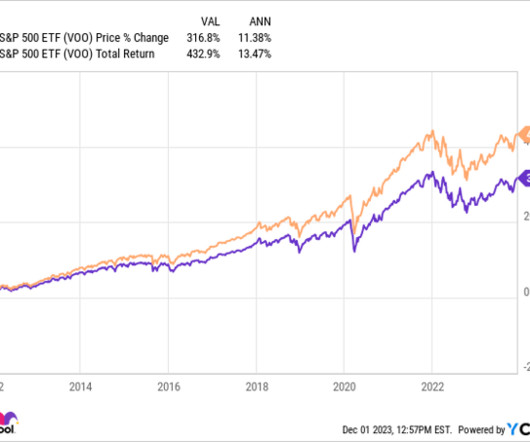

Meet the Only Vanguard ETF That Has Turned $10,000 Into $93,000 Since 2010

The Motley Fool

NOVEMBER 16, 2024

Vanguard markets 86 exchange-traded funds (ETFs). You can buy Vanguard bond and stock ETFs of nearly any flavor. But that's not too hard to do, with stocks and bonds soaring. What's more important is how these funds have performed over the longer term. Image source: Getty Images.

Let's personalize your content