Why VinFast Auto Stock Zoomed Nearly 12% Higher on Tuesday

The Motley Fool

OCTOBER 22, 2024

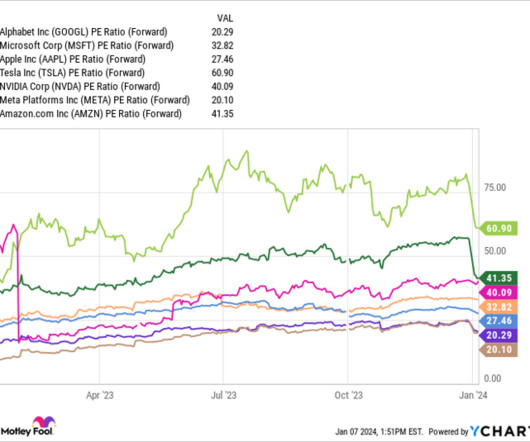

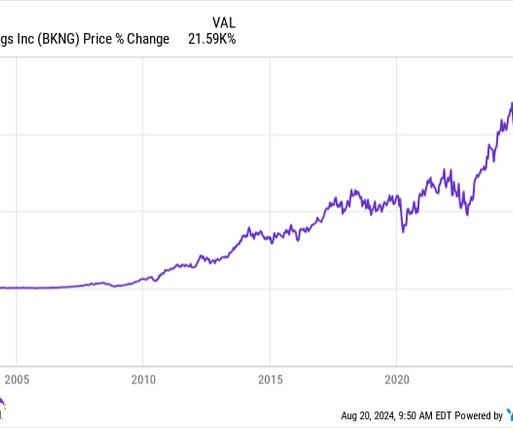

initial public offering (IPO) last year, but investors have cooled on it recently due to a relatively steep Q2 loss. And the numbers speak for themselves: Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,294 !* Keep your eyes on the road VinFast was a hot stock after its U.S.

Let's personalize your content