Meet the Only Vanguard ETF That Has Turned $10,000 Into $93,000 Since 2010

The Motley Fool

NOVEMBER 16, 2024

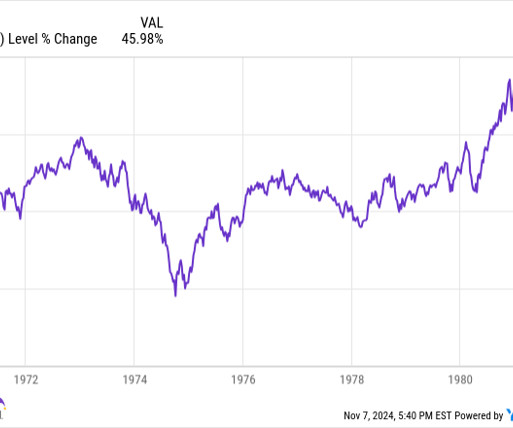

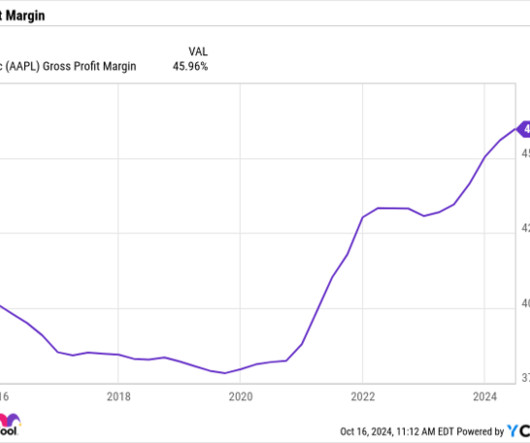

Thirty Vanguard ETFs have delivered year-to-date returns of at least 20%. Meet the only Vanguard ETF that has turned $10,000 into more than $93,000 since 2010. But since the fund's inception in September 2010, it's the best-performing Vanguard ETF of all. However, I think the ETF is still a smart pick for long-term investors.

Let's personalize your content