What's the Best Way to Invest in Stocks Without Any Experience? Start With This ETF.

The Motley Fool

SEPTEMBER 18, 2024

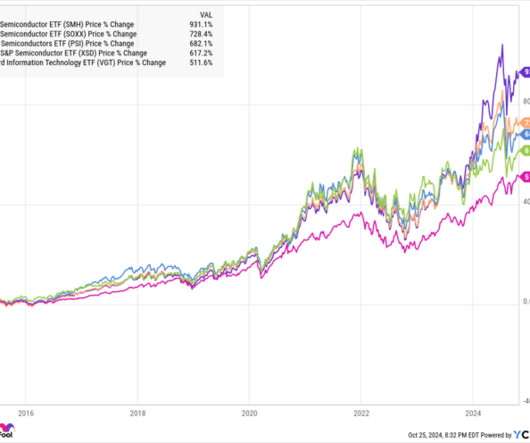

That option is an exchange-traded fund (ETF). ETFs are similar to mutual funds but they are more accessible to the average investor and they trade more like stocks. The ETF's return closely follows the returns of the index (less the management fees the ETF changes). Past three years: 9.6% Past five years: 15.1%

Let's personalize your content