History Says Being Added to S&P 500 Will Have This Impact on Palantir Stock

The Motley Fool

SEPTEMBER 11, 2024

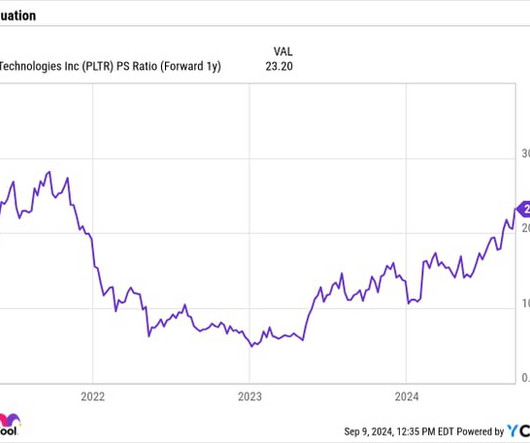

stocks and there is an enormous amount of investor money tied to the index because so many exchange-traded funds (ETFs) and mutual funds track/mimic its performance. pps 2011 to 2021 +0.04 Between 2011 and 2021, stocks added to the S&P showed a decline of 0.04 pps 2011 to 2021 -0.12

Let's personalize your content