3 Midstream Stocks to Buy With $5,000 and Hold Forever

The Motley Fool

NOVEMBER 26, 2024

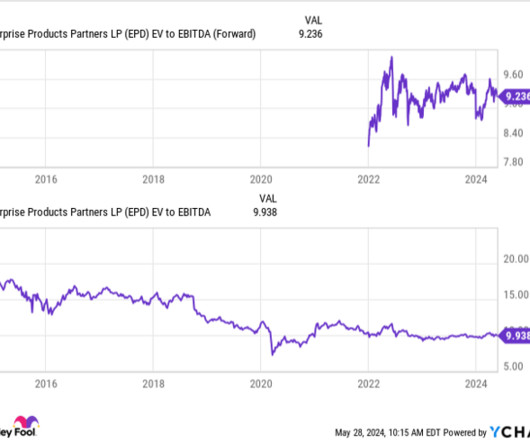

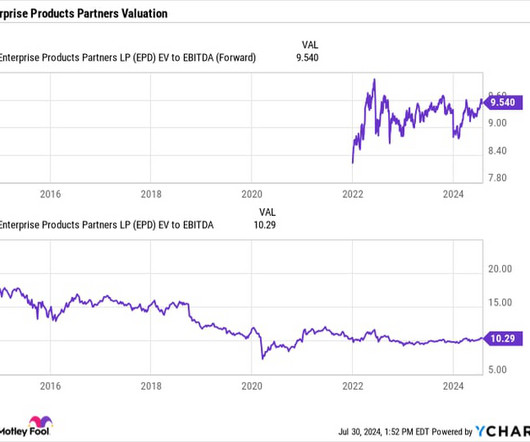

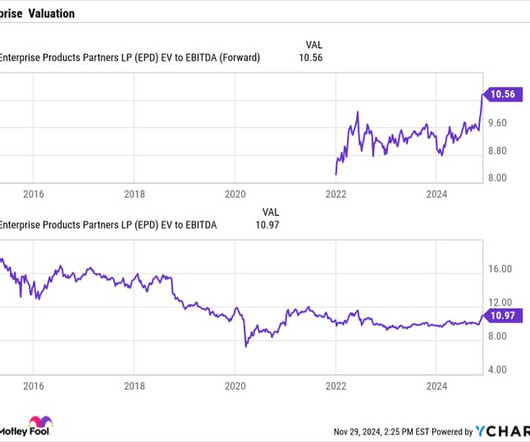

The sector has gone through a transformation in the past decade, with midstream companies reducing leverage and being more disciplined when it comes to funding growth projects. multiple that midstream MLPs traded at between 2011 and 2016. All three stocks trade well below the MLP average multiple from that 2011-to-2016 period.

Let's personalize your content