Warren Buffett Just Sent Wall Street a Historic $127 Billion Warning. History Says the Stock Market Will Do This Next.

The Motley Fool

NOVEMBER 6, 2024

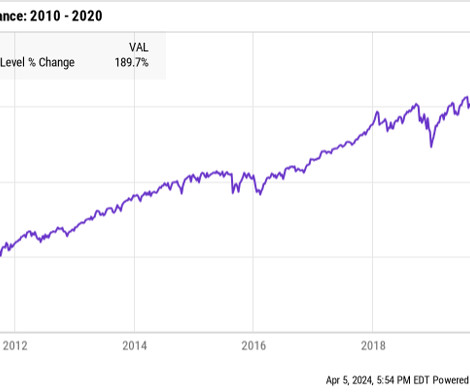

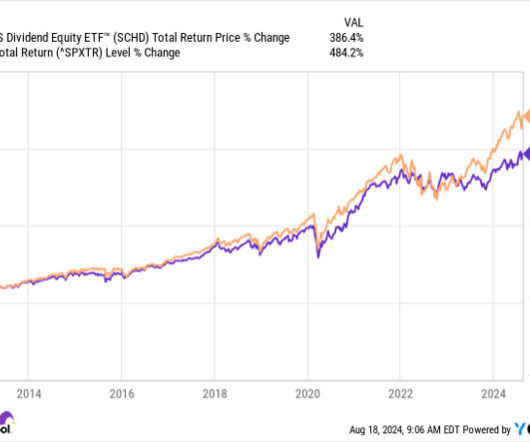

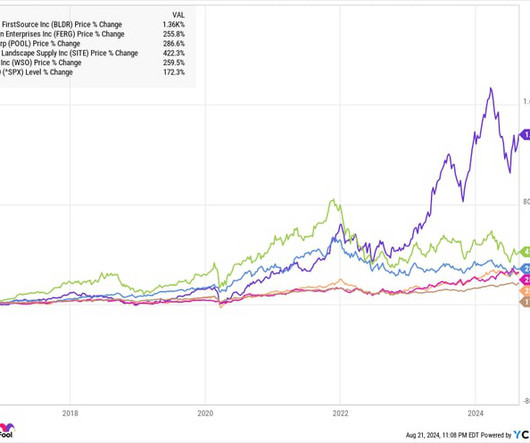

Buffett and his fellow investment managers are clearly struggling to find reasonably priced stocks. But individual investors should not misinterpret that warning as a reason to avoid the stock market. billion in 2011, and the S&P 500 returned 13% in 2012. Here's why. Image source: Getty Images. billion 13% 2013 $4.7

Let's personalize your content