1 Unstoppable Multibagger Up 1,280% Since 2011 to Buy and Hold Forever

The Motley Fool

SEPTEMBER 15, 2024

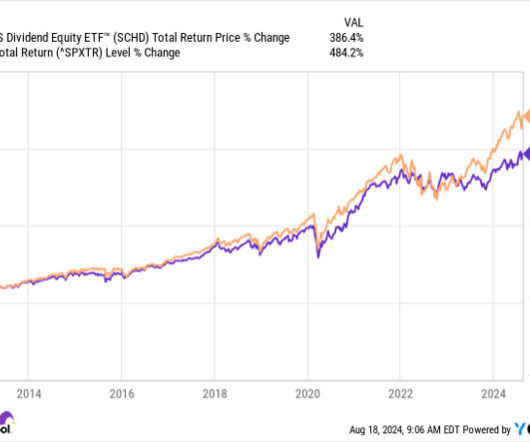

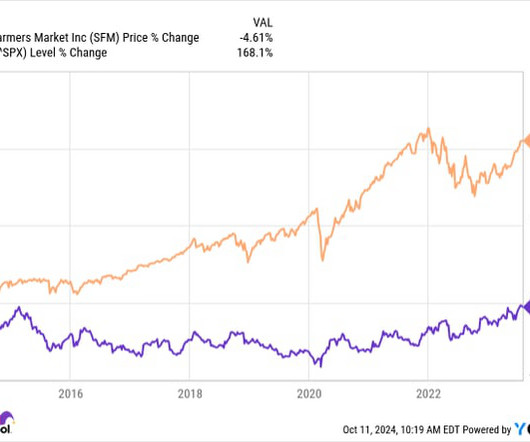

Acquiring high-quality companies in adjacent, similar verticals to its existing business lines, Federal Signal has become a 13-bagger since 2011. The 10 stocks that made the cut could produce monster returns in the coming years. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Let's personalize your content