Does Palo Alto Networks Deserve Its Premium Valuation?

The Motley Fool

AUGUST 25, 2024

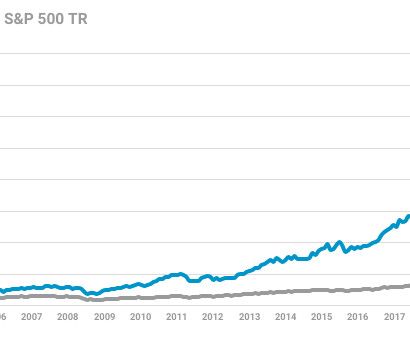

Palo Alto's scale and diversification have enabled it to grow rapidly since its initial public offering in 2012. From fiscal 2012 to fiscal 2023, its revenue had a compound annual growth rate (CAGR) of 35%.

Let's personalize your content