1 Brilliant Warren Buffett Holding Most Investors Should Own

The Motley Fool

OCTOBER 22, 2023

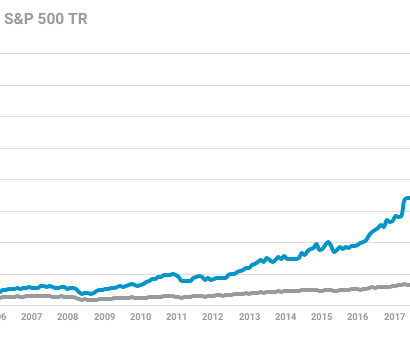

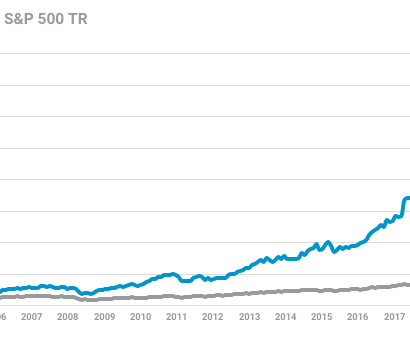

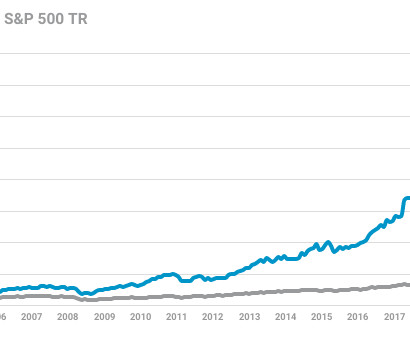

In Berkshire's 2013 annual shareholder letter, Buffett laid this strategy bare by noting that a mix of 10% cash in short-term government bonds and 90% in a low-cost S&P 500 index fund would likely deliver superior returns compared to most professional money managers who charge high fees. How has the VOO performed historically?

Let's personalize your content