This Fast-Growing Company Just Repurchased $4.8 Billion in Shares -- Its Second-Biggest Quarterly Buyback Ever. Should Investors Jump on the Stock?

The Motley Fool

APRIL 8, 2024

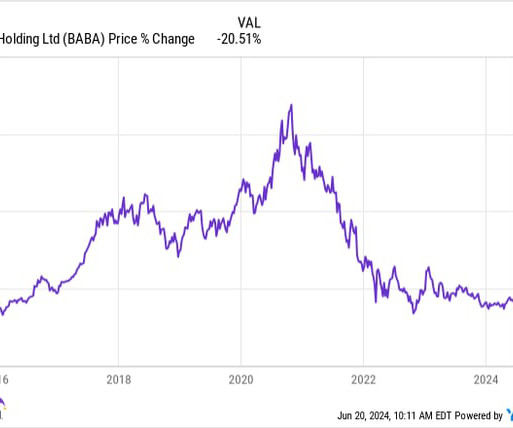

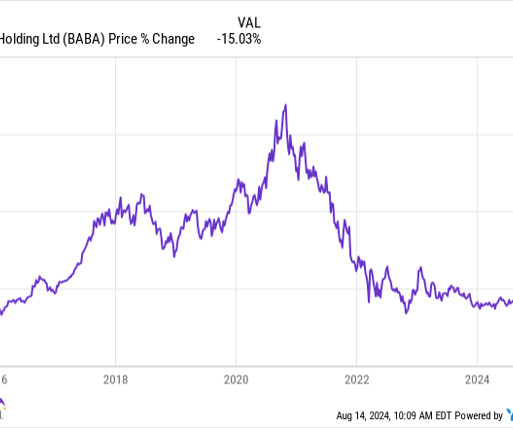

This continues Alibaba's struggles, a stock that has suffered a net loss since its initial public offering (IPO) in 2014. regulators threatened to delist Alibaba and several other Chinese stocks if they could not access Chinese companies' audits. The problem directly affected the investment world in 2022 when U.S.

Let's personalize your content