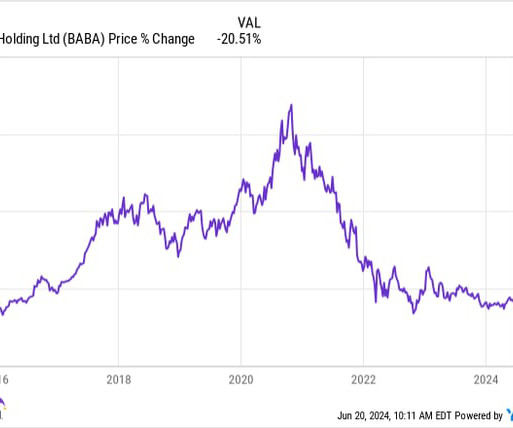

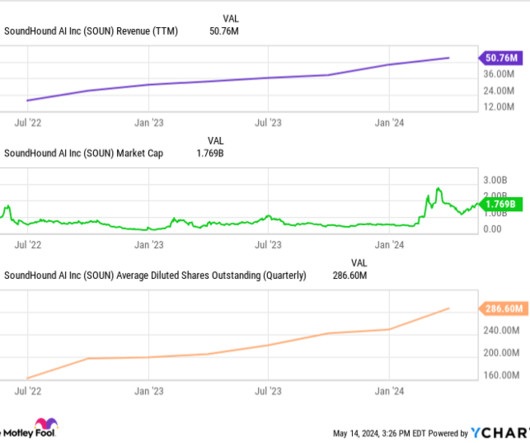

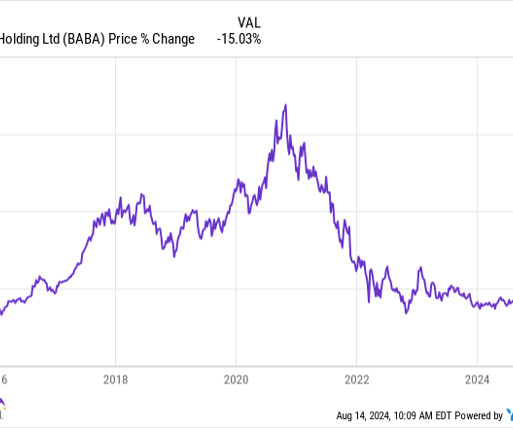

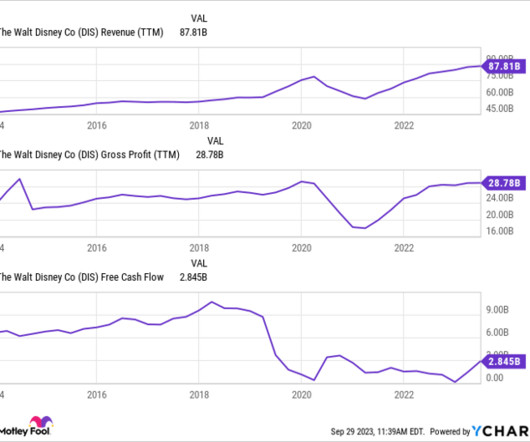

3 Unstoppable Multibaggers Up Between 965% and 3,450% Since 2014 to Buy After a Recent Pullback

The Motley Fool

NOVEMBER 20, 2024

Here's why I believe these short-term drops in price could prove to be an opportunity for investors thinking a decade ahead. Ultimately, I believe this pullback gives investors an opportunity to pick up shares of one of the best compounders on the market today at a discount. market by roughly 10 years.

Let's personalize your content