Billionaire Stanley Druckenmiller Has 39% of His Portfolio in These 3 Companies

The Motley Fool

MAY 4, 2024

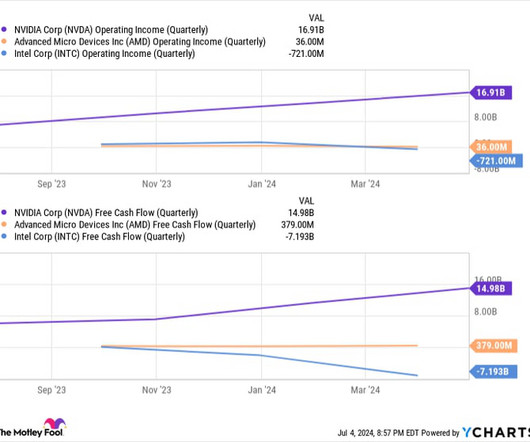

Nvidia Nvidia (NASDAQ: NVDA) is Druckenmiller's largest investment, accounting for just over 16% of his portfolio. One is Nvidia stock, which is 9% of the overall portfolio. However, Duquesne invested an additional 7% of the portfolio in Nvidia call options. These are highly leveraged investment products. trillion size.

Let's personalize your content