7 Reasons Buying $1,000 of This 7.8%-Yielding Dividend Stock Could Be a Brilliant Move

The Motley Fool

FEBRUARY 12, 2024

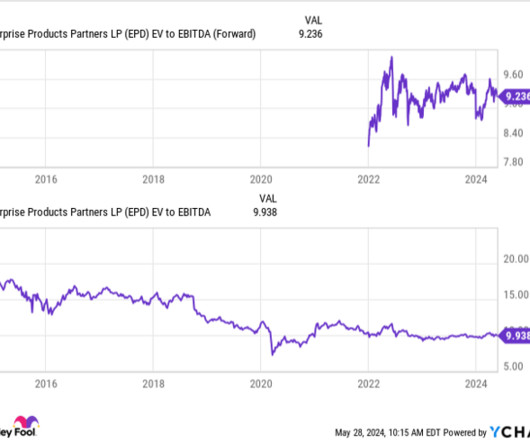

For example, Enterprise delivered a double-digit return on invested capital (ROIC) in every year since 2005. This period included the financial crisis that began in 2007, the oil price collapse from 2014 through 2017, and the COVID-19 pandemic. That means it issues K-1 tax forms, which make tax preparation more complicated.

Let's personalize your content