1 Warren Buffett Stock Down 62% to Buy in 2024 and Hold

The Motley Fool

JANUARY 1, 2024

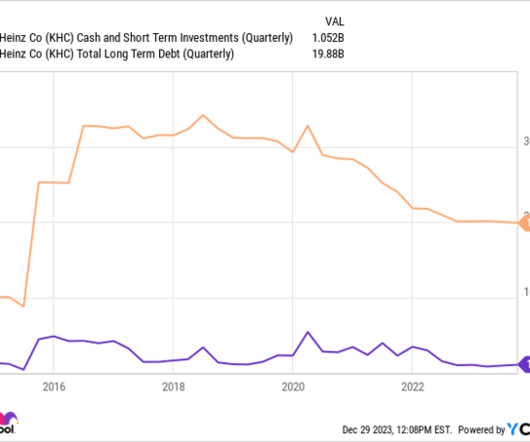

Food conglomerate Kraft Heinz (NASDAQ: KHC) is a rare example of his investments gone bust. After all, he's owned it since he helped arrange a merger to create the entity in 2015. Cleaning up messy financials Kraft Heinz was created in 2015 when Kraft Foods Group merged with Heinz Holding Corporation. Is it stubbornness?

Let's personalize your content