Let's Get Real About Social Security and Immigration

The Motley Fool

NOVEMBER 24, 2024

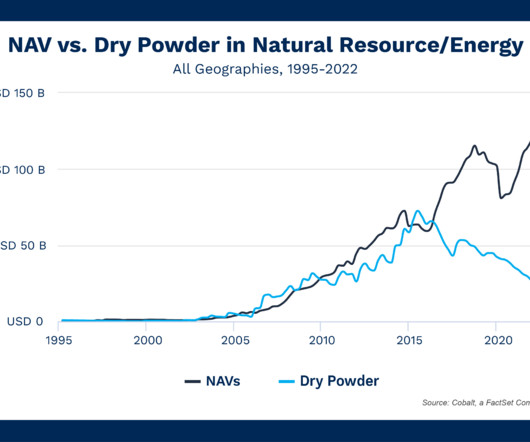

Over time, a greater percentage of earned income -- wages and salary, but not investment income -- has escaped the payroll tax. Legal immigration into the U.S. A majority of the legal immigrants that enter the U.S. payroll tax on earned income. The payroll tax accounted for 91.3% Legal net migration into the U.S.

Let's personalize your content