Investors Are Convinced They've Found the Next Chipotle

The Motley Fool

JUNE 19, 2023

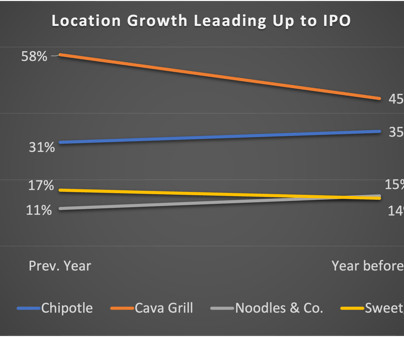

Since it first came to the public markets with a 100% gain in its 2006 debut, Chipotle Mexican Grill (NYSE: CMG) has been a stock market darling. Shares have climbed 45-fold since that initial public offering (IPO) and 375% since the beginning of 2019. That's a lot easier than securing sites and building new restaurants.

Let's personalize your content