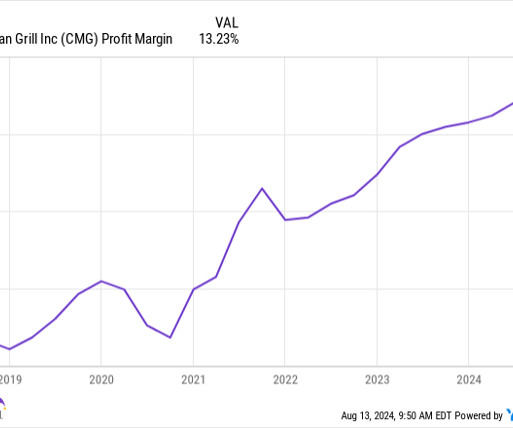

This Overlooked Stock Is Up 392% Since 2018 and Has Plenty of Growth Left

The Motley Fool

DECEMBER 7, 2023

For instance, there is an insurance stock many may not know of that has returned 392% since it went public in 2018. Since Goosehead went public in April 2018, the stock has crushed it. This stellar stock performance rivals that of Apple while outpacing Amazon , Microsoft , and Alphabet over the same period.

Let's personalize your content