Where Will Carnival Stock Be in 3 Years?

The Motley Fool

DECEMBER 1, 2023

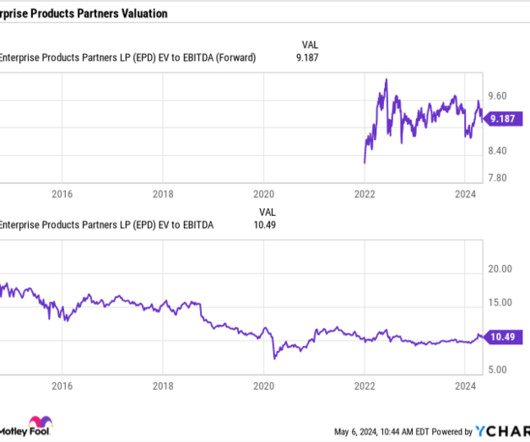

The cruise line operator's revenue plunged in 2020 and 2021 as global travel ground to a halt during the pandemic, and it was forced to take on a lot more debt to stay solvent. On an adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) basis, it generated a profit of $3.3 It ended fiscal 2019 with $9.7

Let's personalize your content