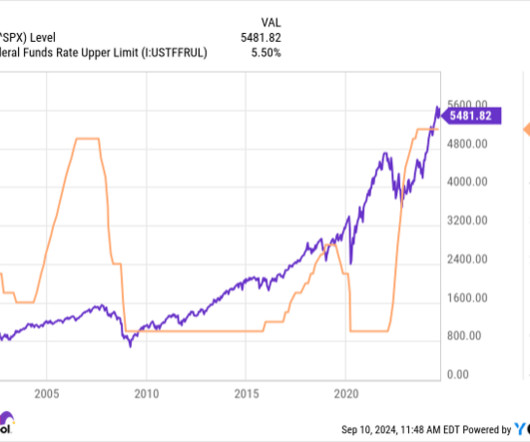

Interest Rates Recently Did Something They Haven't Done Since March 2020, and It Could Trigger a Big Move in the Stock Market

The Motley Fool

NOVEMBER 23, 2024

Thankfully, inflation has cooled significantly since then, which allowed the Fed to cut interest rates in September for the first time since March 2020. government injected trillions of dollars into the economy throughout 2020 and 2021 to counteract the negative effects of the COVID-19 pandemic.

Let's personalize your content