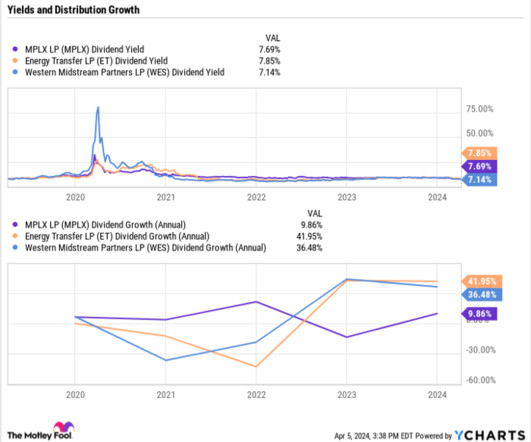

Why Energy Transfer Is My Top Investment for Passive Income

The Motley Fool

OCTOBER 8, 2024

I first added the midstream giant to my portfolio in early 2020, right before the pandemic hit. It repaid debt, which steadily drove down its leverage ratio. Today, Energy Transfer has a strong investment-grade balance sheet with a leverage ratio in the lower half of its 4.0-to-4.5x times target range.

Let's personalize your content