Meet the Artificial Intelligence (AI) Stock That Attracted Nvidia's Biggest Investment

The Motley Fool

MARCH 28, 2024

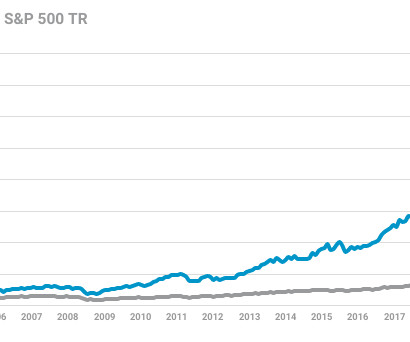

Nvidia filed its first-ever 13F with the Securities and Exchange Commission (SEC) on Feb. An eclectic bunch Nano-X Imaging developed a more cost-effective X-ray machine that leverages AI to help provide more accurate diagnoses. Image source: Getty Images. times the worth of all its other holdings, combined.

Let's personalize your content