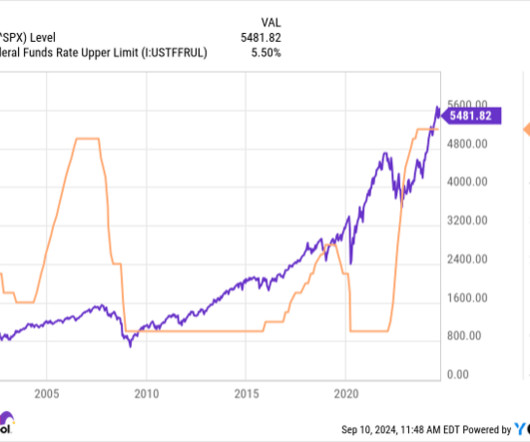

Interest Rates Just Did Something They Haven't Done Since March 2020, and It Could Foreshadow a Big Move in the Stock Market

The Motley Fool

OCTOBER 13, 2024

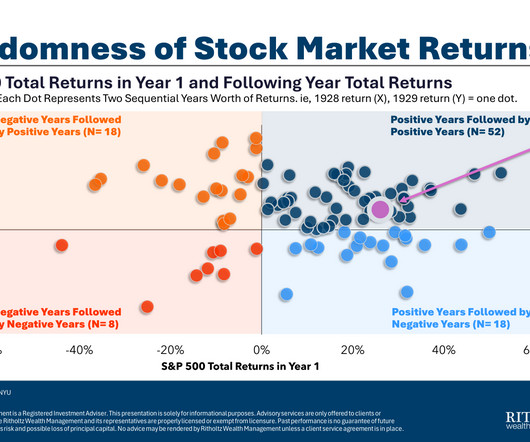

Thankfully, it has cooled significantly since then, which allowed the Fed to reduce the federal funds rate in September, for the first time since March 2020. The stock market doesn't always like rate cuts in the short term Falling interest rates can be great for the stock market.

Let's personalize your content