Could Roku Be a Millionaire-Maker Stock?

The Motley Fool

NOVEMBER 4, 2024

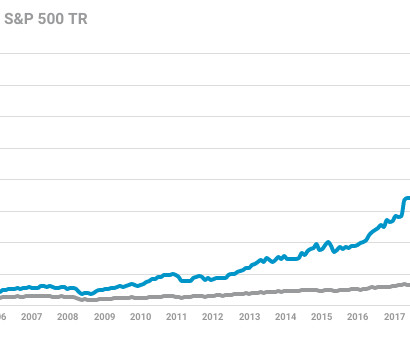

Roku (NASDAQ: ROKU) minted a lot of millionaires in its first four years as a public company. The streaming device and software maker went public at $14 on Sept. on July 26, 2021. Period 2017 2018 2019 2020 2021 2022 2023 Active Accounts (Millions) 19.3 A $30,000 investment in its IPO would have blossomed to $1.03

Let's personalize your content