Does Stanley Druckenmiller Know Something David Tepper Doesn't? The Billionaire Investor is Avoiding the China Rally and Investing in Another Foreign Market Instead.

The Motley Fool

OCTOBER 26, 2024

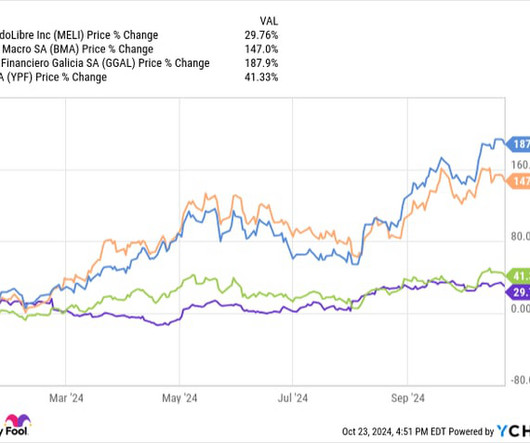

There may not be two investors with more successful careers than billionaires Stanley Druckenmiller and David Tepper. It's hard to believe that two investors as successful as Druckenmiller and Tepper could have such different views of the market, but that's why we have a market. In 2021, regulators fined Alibaba a record $2.8

Let's personalize your content