Is Robinhood Stock a Buy?

The Motley Fool

AUGUST 12, 2024

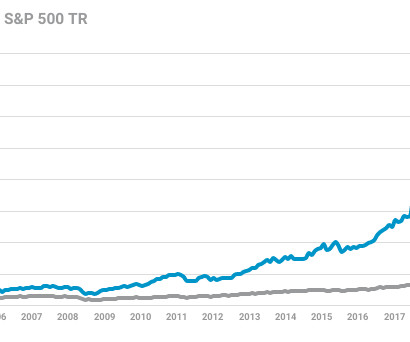

Robinhood is bouncing back from a tough slowdown Robinhood initially carved out a niche among smaller retail investors with its commission-free trades, streamlined app, and gamification of the trading process. But in 2022, its number of funded customers only grew 1% to 23 million as its MAUs declined 34% to 11.4

Let's personalize your content