Why Carnival Stock Skyrocketed 130% in 2023

The Motley Fool

JANUARY 9, 2024

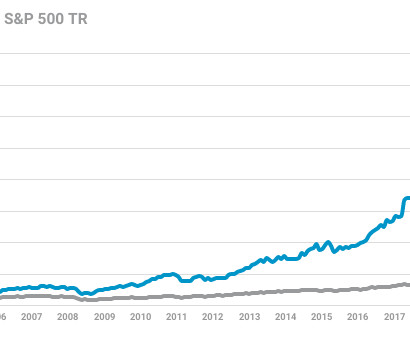

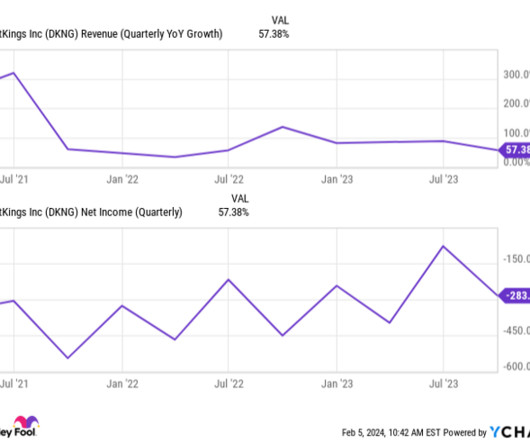

NYSE: CCL) stock gained 130% in 2023 according to data provided by S&P Global Market Intelligence. Carnival came into fiscal 2023 with $12 billion in annual revenue and a $1.6 billion for fiscal 2024, or 30% more than 2023, and net yield up 8.5%. billion in 2023. Carnival Corp. billion loss. There's still risk today.

Let's personalize your content