Why Global-e Stock Jumped 16% in December

The Motley Fool

JANUARY 8, 2024

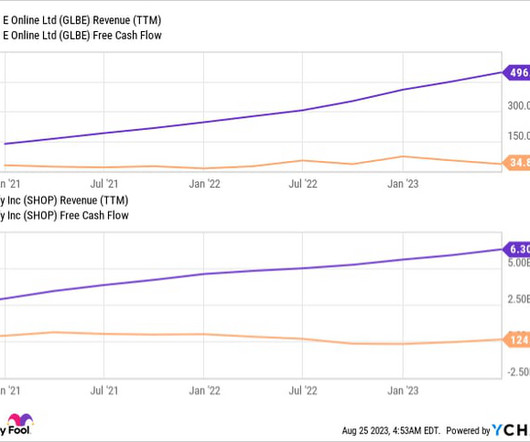

Revenue increased 27% year over year in the 2023 third quarter. Adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ), which removes things like one-time charges and expenses related to the initial public offering, increased from $12.5 million to $22.1 million to $22.1

Let's personalize your content