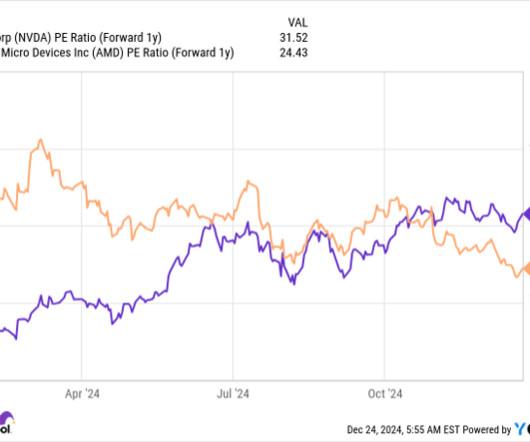

2 Super Semiconductor Stocks (Besides Nvidia) to Buy Hand Over Fist in 2025

The Motley Fool

DECEMBER 26, 2024

We're just days away from ringing in the new year, and the holiday break can be a good time for investors to review their portfolios and examine potential opportunities for 2025. Artificial intelligence (AI) was a dominant theme in the stock market during 2024, and tech giants are poised to spend a record amount of money developing the technology over the next 12 months.

Let's personalize your content