2 Bargain-Basement Stocks to Buy Now to Make You Richer

The Motley Fool

JUNE 20, 2023

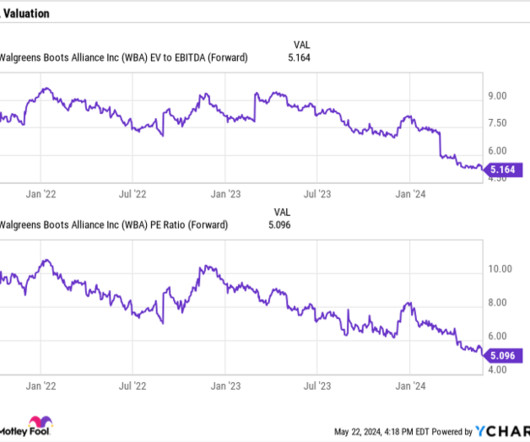

Those entities have some tax complexities, which tend to weigh on their valuations compared to traditional corporations. In addition, some already tax-advantaged accounts (IRAs) don't allow investors to hold partnership units, and many stock market indexes don't allow partnerships. billion to $13.5 That puts its valuation at 7.2

Let's personalize your content