Should You Forget Bitcoin and Buy XRP Instead?

The Motley Fool

NOVEMBER 3, 2024

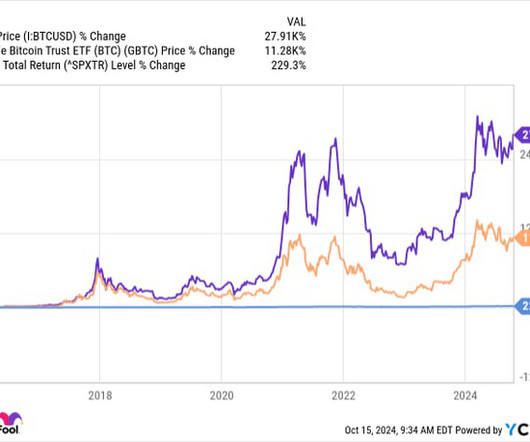

Second, Grayscale recently relaunched its XRP Trust as a closed-end fund ( CEF ) for accredited investors in response to Ripple's partial victory. Those new funds could stabilize XRP's price and lock in more mainstream investors. Bitcoin 's (CRYPTO: BTC) price has doubled during the past 12 months.

Let's personalize your content