3 High-Yield Dividend Stocks to Buy Now for a Lifetime of Passive Income

The Motley Fool

JUNE 25, 2024

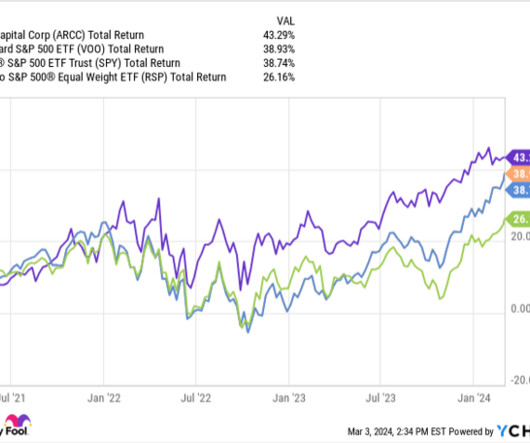

AbbVie (NYSE: ABBV) , Ares Capital (NASDAQ: ARCC) , and Realty Income (NYSE: O) have what it takes to deliver heaps of dividend payments to your portfolio in the years ahead. Ares Capital Ares Capital is a business development company ( BDC ) that offers a huge 9.3% of its portfolio at cost was on non-accrual status.

Let's personalize your content